Strategic Plan

UK Financial Services Industry

The UK Financial Services Sector

A roundup of information about the UK financial services industry.

For comments, ammendments and additions, go to https://www.chriscfox.com/Contact

Plan submitted by:

Chris Fox

Analysis

McKinsey 7S Analysis

Strategy

Skills

Structure

- Providers have a massive estate of customer assets

Staff

- A bonus culture drives greed and resentment

- Executives are out of touch with the needs of their retail customers

Systems

- Firms have a wealth of customer data that they could mine

Style

- Products are too complex and use too much jargon

PESTEL Analysis

Porter's Five Forces Analysis

Threat of substitutes

- Brexit could weaken the UK financial services sector

- NEST could undermine competitiveness in the pensions sector

- New entrants to the market are disrupting with technology

- Peer-to-peer lending is growing rapidly

- The FCA could continue to intervene in the provision of financial services

Bargaining power of suppliers

- The mass market is underadvised

- 'Regtech' could help financial services providers streamline the costs of regulatory compliance

Rivalry

- Basel III

- The 2014 budget provided the biggest shakeup of retirement savings in a generation

- InsurTech / InsTech

- More advice is being delivered remotely

Bargaining power of buyers

- Open Finance - Open Banking and the Pensions Dashboard

- Consumers are unengaged and do not take advice

- Autoenrolment has increase the number of people engaged in long-term savings

- MIFID II could further constrain distribution

- Consumers are moving online and mobile

- Consumers are working longer / phasing retirement to make ends meet

- Erosion of pension and savings pots leaves consumers playing catch-up

- Erosion of state benefits and DB pensions means consumers must increasingly self-provide

- Global warming and pollution could negatively impact health and longevity

- Online financial planning website could plug the advice gap

- Pensions freedoms could expose the market to mis-selling and scams

- Providers could be forced to offer advice, directly or via a partnership, in order to serve the mass market

- Artificial Intelligence and Automation could make financial services more affordable

- The pensions charge cap could distort the market

- The Simplified Products initiative could further commoditise the market

- The size of the advice market is constrained

- There exists a protection gap

- A shift towards workplace has a negative impact on individual business (esp life/IP etc.) but this could have long-term impacts if/when you leave

Threat of new entrants

- Admired non-financial services brands are entering the market

- Challenger Banks

- Extra-industry firms may have access to better data for assessing risk

SWOT Analysis

Insight Details

Open Finance - Open Banking and the Pensions Dashboard

The FCA has backed the idea of open finance as a way of increasing access to advice. (Source: FCA says open finance could improve advice - FTAdviser.com)

For example:

- Open Banking

- The Pensions Dashboard

Open Banking

According to McKinsey Consulting: If open finance continues to accelerate, it could reshape the global financial services ecosystem, change the very idea of banking, and increase pressure on incumbents.

Source: Financial services unchained: The ongoing rise of open banking | McKinsey, published 11 July 2021

The Pensions Dashboard

The 'pensions dashboard' could make it easier for customers to move and consolidate their pensions

On average, a UK adult can now expect to have 11 jobs in their lifetime. With the advent of AE, they will have a similar number of pensions. Currently, it is incumbent on the individual to monitor each of those pensions, as well as their state pension and DB pension entitlements, separately. A pensions dashboard would bring all that information together on one digital platform. Countries including the Netherlands, Australia and Sweden already have pension dashboards. Source: Pension freedoms - Work and Pensions Committee - House of Commons

The plan behind the pension dashboard, which was originally due to launch in 2019, is to create the technology to allow savers to see all of their retirement pots in one place at the same time, giving them a greater awareness of their assets and how to plan for their retirement. (Source: Bill for pension dashboard study hits £100K - FTAdviser.com)

The government initially signposted that every provider will move to providing access to their data in this manner.

More recently, government support wavered. The government then said industry should take the lead, and that it would not force providers to provide client data.

ThIt works off the back of the gov.uk verify service.

See https://www.pensionsdashboardsprogramme.org.uk/

The Ultimate Statutory Connection Deadline is now 31 October 2026.

Summary

The UK's financial services sector is undergoing a significant transformation with the evolution from Open Banking to Open Finance, aiming to provide consumers with a comprehensive view of their financial landscape. Open Banking, initiated in 2018, mandated major banks to share customer data with authorised third-party providers, fostering innovation and competition. This framework has enabled the development of financial apps that assist users in managing their finances more effectively. (Wikipedia)

Building upon this foundation, Open Finance seeks to extend data-sharing principles beyond banking to encompass a wider array of financial products, including loans, savings, investments, pensions, and insurance. This expansion aims to empower consumers with a holistic view of their financial positions, facilitating informed decision-making and enhanced financial well-being. (KPMG)

A pivotal component of this initiative is the Pensions Dashboard Programme, designed to allow individuals to access all their pension information in one place. This tool addresses the issue of 'lost' pension pots, which have increased in value by nearly 20% over the past two years, reaching £31 billion across 3.3 million unclaimed or inactive accounts. The dashboard is expected to improve engagement with retirement planning and is scheduled for rollout beginning in April 2025. (Financial Times)

Consumer interest in such tools is high; over 90% of UK consumers with retirement savings expressed willingness to use a digital dashboard to consolidate their pensions, savings, and investments. However, concerns about data security and potential mis-selling remain barriers to adoption. Ensuring robust security measures and clear regulatory frameworks will be crucial in building and maintaining consumer trust. (TISA)

The transition to Open Finance represents a strategic shift towards greater financial transparency and consumer empowerment in the UK. By integrating various financial data sources, including the forthcoming Pensions Dashboard, the initiative aims to provide individuals with a comprehensive understanding of their financial health, promoting informed decision-making and improved financial outcomes.

- PersionsDashboardProgramme:

- Money and Pensions Service (MaPS):

-

Capgemini:

Selected to supply the central digital architecture to underpin the online data platforms for the Pensions Dashboard.

Consumers are unengaged and do not take advice

- The PLSA found that 32% of individuals accessing their pots under pension freedoms paid for regulated financial advice.

- The FCA found that the proportion of drawdown products bought without advice has risen from 5% before the introduction of pension freedoms to 30% afterwards.

- 63% of all annuity sales in the year to September 2016 were made to non-advised customers.

- There is a significant correlation between an individual’s pension pot size and the likelihood of them seeking financial advice. While 89% of people with pots worth over 500,000 sought advice, this was true of just 20% of individuals with a pension pot of less than 10,000.

- Advice is perceived as expensive.

- The FCA found that 51% of people would not be prepared to pay for advice at any price.A widespread lack of trust in financial

advisers, and a lack of engagement with pensions contribute to this effect. - Advisers may also turn away potential clients if advising them is not likely to be profitable.

Source: Pension freedoms - Work and Pensions Committee - House of Commons

Financial services incumbents are increasingly technology companies

More financial services incumbents are developing core parts of their proposition themselves.

- Hargreaves Lansdown

- Novia (Source: Novia 'not complacent' after multi-million pound upgrades published 09/05/2019)

Poor productivity is a major issue for the UK

"Workers are no more productive now than on the eve of the financial crisis in 2008. There is a productivity gap of 15 per cent to 19 per cent between the UK and the other six members of the G7 group of nations, according to the Office for National Statistics (ONS)." (Source: Why talk about productivity? - FTAdviser.com)

A bonus culture drives greed and resentment

The FSA has said that many if not all of the recent mis-selling scandals over products including payment protection insurance (PPI), endowments and pensions had come about because of the way companies rewarded sales rather than service.

Bonuses have tended to be the highest in the investment banking sector.

Autoenrolment has increase the number of people engaged in long-term savings

As of May 2018, autoenrollment is credited with bringing an extra 9 million people into workplace savings schemes, and total savings into workplace pension schemes are forecast to increase by £20bn in 2019/20. (Source: Pension freedoms - Work and Pensions Committee - House of Commons)

There remain, however, some challenges:

- However, note that it will also place an enormous burden on businesses, especially small ones.

- Research by insurer Scottish Widows shows that only 33% of the nation's 4.5m self-employed workers, who do not qualify for autoenrollment, are adequately prepared.

- Uncertainty around pensions freedoms make it less clear what those people will do with the funds at requirement.

- On average, a UK adult can now expect to have 11 jobs in their lifetime. With the advent of AE, they will have a similar number of pensions. (Source: Pension freedoms - Work and Pensions Committee - House of Commons)

- AE still leaves people with a savings pot rather than a pension.

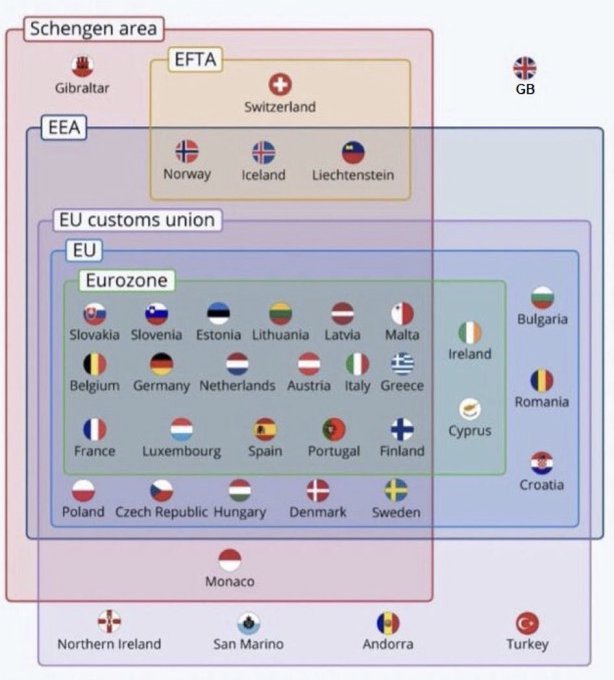

Brexit could weaken the UK financial services sector

On 23 June 2016, Britain voted in a referendum to exit the European Union, and subsequently exited.

In 2023 we continue to argue about whether it has been a success or not.

Any trade and other arrangments negotiated during (or after) that period, must be agreed with at least 20 of the EU nations representing at least 65% of the EU population.

The implications for the UK Financial Services Sector are many:

- Political turmoil: The resignation of David Cameron has led to a revolving door of prime minister including Theresa May, Boris Johnson, Liz Truss and now Rishi Sunak.

- Economic: The BoE has estimated that Brexit has cost the UK more than COVID did. Oliver Wyman had estimated that as much as 25% of U.K. Financial services profits could be EU linked. However, all estimates are hotly contested.

- Regulatory: It is estimated that 55% of the UKs laws (about 80,000 pages) derive from Europe and will have to be resolved. This will detract legislators and parliament from other work in the sector (see below), and will also divert private resources from other strategic initiatives. The FCA has already issued a statement advising firms that the all regulations remain in force and that they should continue to work on complying and/or implementing them whether or not they derive from Europe. In the longer term, however, we might expect direct impacts on:

- Pensions reform

- LISA

- Any recommendations which may arise from the Dormant Asset Commission

- The Financial Advice Market Review ("FAMR")

- MiFID II

- Solvency II

- Basel III

- Packaged Retail Investment and Insurance-based Investment Products (PRIIPS)

- Regulatory passporting: there are apparently 8,000 firms who rely on some form of passporting.

- UK legislative programmes, which might get deprioritised:

- UK regulatory programmes, which might get deprioritised:

- EU specific directives, such as:

- Regimes dependent on EU membership, such as:

- Labour: Brexit ends freedom of movement between the UK and the EU (in both directions).

From Twitter.

Basel III

Basel III (or the Third Basel Accord) is a global, voluntary regulatory framework on bank capital adequacy, stress testing, and market liquidity risk. It was implemented in the European Union as part of the legislative package comprising Directive 2013/36/EU (CRD IV) and Regulation (EU) No. 575/2013 on prudential requirements for credit institutions and investment firms (CRR). (Note, therefore, the potential impact of Brexit.)

The Basel III proposals sought to strengthen the regulatory regime applying to credit institutions in the following areas.

- Enhancing the quality and quantity of capital.

- Strengthening capital requirements for counterparty credit risk (and in CRD III for market risk) resulting in higher Pillar I requirements for both.

- Introducing a leverage ratio as a backstop to risk-based capital.

- Introducing two new capital buffers: one on capital conservation and one as a countercyclical capital buffer.

- Implementing an enhanced liquidity regime through the Net Stable Funding Ratio and Liquidity Coverage Ratio.

Based on the European Commission’s timetable, the implementation transition period is expected to run until 2021.

Solvency II

The Solvency II Directive (2009/138/EC) is an EU Directive that codifies and harmonises the EU insurance regulation - primarily the amount of capital that EU insurance companies must hold to reduce the risk of insolvency. (Note the potential impact of Brexit.)

Solvency II is likely to increase the capital adequacy requirements of Life Insurance and Lloyds Market insurance (more so than general insurers).

It is too early be sure of the impact and a period of consolidation and regulatory alignment is required.

MIFID II could further constrain distribution

The Markets in Financial Investments Directive (MiFID) is an EU Directive harmonised regulation for investment services across the 31 member states of the European Economic Area (the 28 EU member states plus Iceland, Norway and Liechtenstein). (Note, therefore, the potential impact of Brexit.)

MIFID II is designed to increase transparency and investor protection after the financial crisis.

MIFID II could have a number of consequences:

- advisers could be forced to record all calls and even face-to-face conversations.

- MIFID II has introduced a European-wide definition of 'independence' which requires independent firms to make recommendations based on a “sufficient range” of providers’ products rather than the whole market as under the FCA’s definition, but it extends to a wider range of products. The FCA has said it is “open-minded” about changing its independent and restricted labels after its post-implementation review of the RDR found they were not well understood by consumers. (This is all likely to force advisers to become more specialised in the types of products on which they advise.

- Execution-only and direct offer may no longer be an option for many products.

- Further tightening around 'inducements' like extravagant hospitality.

- The only area where MIFID II might result in the FCA becoming more lenient is in disclosure of costs. MIFID II recognises that it might be difficult for advisers to present the sum of all costs as a single figure.

The European Parliament confirmed the delay in implementing MiFID II to 3 January 2018.

Consumers are disillusioned after financial scandals and economic malaise

- The collapse of the Woodford fund.

- Deutsche Bank signed a $7.2bn settlement with the US Department of Justice to do with misleading investors in residential mortgage-backed securities.

Consumers are moving online and mobile

The UK financial services sector has experienced a significant shift towards online and mobile platforms, reflecting changing consumer preferences and technological advancements. Key trends include:

-

Increased Adoption of Digital Banking: In 2023, 87% of UK adults used remote banking services, with mobile banking usage rising from 53% to 60%, and online banking via computer slightly decreasing from 65% to 62%. (UK Finance)

-

Growth of Digital-Only Banks: Approximately 24% of UK consumers held accounts with digital-only banks in 2023, a figure that rises to 50% among those aged 18 to 24. However, only 12% used these accounts as their primary bank. (Compare Banks)

-

Rise in Mobile Contactless Payments: One-third of UK adults used mobile contactless payments in 2023, indicating a growing preference for mobile-based financial transactions. (UK Finance)

-

Decline in Cash Usage: Cash transactions accounted for only 12% of all payments in 2023, highlighting a move towards digital payment methods. (Financial Times)

-

Regulatory Scrutiny of Digital Wallets: With over half of UK adults now using digital wallets, British regulators are examining the implications of Big Tech's involvement in financial services to ensure fair competition and consumer protection. (Reuters)

This digital transformation presents opportunities for financial institutions to innovate and offer enhanced services. However, it also poses challenges, particularly in ensuring accessibility for all demographics and maintaining robust security measures.

The advantages are numerous:

- Cost savings from

- simplified processes

- self-service

- reduced cycle times

- better information and decision making

Customers are living longer, but not necessarily in as good health

Longevity is already on the increase as a result of improved

This could be tremendously disruptive for existing solutions such as:

- retirement and

annuitisation - life insurance and assurance

- long-term care costs

Baroness Greengross said: “Our society is in denial of the inevitability of ageing. We have put off the difficult decisions for far too long."

The problem extends beyond financial services, with claims that the countries health care, housing and transportation systems, amongst

According to the ILAG UKprotection strategy report, December 2015

The number of people aged 85 and over is expected to double by 2030 (ONS).

There is a low fertility rate of 1.91, compared to a replacement rate of 2.075, which has been the case since the 1970s.

The baby boom generation is entering the over 65s market.

66% of the UK population is aged 15 – 64 and longevity

Life expectancy has improved by 4% males and 3% females over the past decade, compared to 3% and 2% over the previous decade.

The main drivers for these improvements are attributed to:

- Improved safety and regulations e.g. road, workplace, an increase in health and safety

- Lifestyle changes eg smoking, drinking, activity

- Increased awareness and preventative measures with illnesses e.g. vaccines, earlier identification and more efficient treatments, improved drugs

- Anti-ageing technology

The State Pension Age is increasing to reflect these factors and more people aged over traditional retirement ages are remaining in work longer

Obesity is increasing and impacting health. Males with normal BMI reduced from 41% to 31% (1993 to 2010.) and women from 49% to 40%. (Source NHS).

According to research by Aviva:

- In 1966 life expectancy at birth in the UK

was about 69 for a boy and 75 for a girl. Today, cohort life expectancy at birth is 90 for a boy and 93 for a girl. The ONS has projected by 2066 it could rise to 97 for a boy and 100 for a girl. - In 1917 the monarch sent 24 birthday letters to centenarians. By 1966 there were 910 centenarians, and the ONS estimates there are 14,570 in 2016.

- The state pension retirement ages of 60 for women and 65 for men were set in the 1940s.

Erosion of pension and savings pots leaves consumers playing catch-up

Assuming they can overcome their disappointment in the sector.Erosion of state benefits and DB pensions means consumers must increasingly self-provide

The UK's retirement landscape is undergoing significant changes, compelling individuals to take greater responsibility for their financial futures. This shift is primarily due to the diminishing role of state benefits and the decline of defined benefit (DB) pension schemes.

Erosion of State Benefits:

-

State Pension Age Increases: The State Pension age has been rising, affecting when individuals can access benefits. For instance, women's State Pension age increased from 60 to 65 between 2010 and 2018, aligning with men's, and is set to reach 66 by 2020. These changes have led to reduced household incomes for those in the affected age groups. (Wikipedia)

-

Benefit Reductions: Adjustments to state benefits, such as the reduction in Pension Credit eligibility, have further decreased the financial support available to retirees. These measures have increased poverty rates among older women. (Wikipedia)

Decline of Defined Benefit Pensions:

-

Shift to Defined Contribution (DC) Schemes: The proportion of private sector employees in DB pension schemes halved from 24% in 2005 to 12% in 2020. This decline transfers investment and longevity risks from employers to individuals, making retirement incomes less predictable. (IFS)

-

Scheme Closures: Many DB schemes have closed to new members or future accruals, limiting access to these more secure pension arrangements. This trend has been driven by factors such as increased longevity and financial pressures on employers. (Pensions Policy Institute)

Implications for Individuals:

-

Increased Personal Responsibility: With the reduction in state and employer-provided retirement income, individuals must proactively save and invest to secure their financial well-being in retirement. This includes participating in workplace pensions, personal savings, and other investment vehicles.

-

Need for Financial Literacy: Navigating the complexities of retirement planning requires a higher level of financial literacy. Individuals need to understand investment risks, tax implications, and the importance of long-term saving to make informed decisions.

In summary, the erosion of state benefits and the decline of DB pensions in the UK necessitate that consumers take a more active role in planning and providing for their retirement to ensure financial security in later life.

Executives are out of touch with the needs of their retail customers

Female customers are particularly poorly understood and not pleased with the offerings from the sector. (Boston Consulting Group)

Firms have a wealth of customer data that they could mine

Especially banks, have a wealth of customer transaction data from which they could glean all sorts of insights. No other business has greater insight into its customer just because of their regular operations. Bank can understand where and when people shop and holiday, how much they spend, when their insrance is due for renewal, and can combine this with personal information around date of birth and address, etc.

The adoption of contactless payments now means that banks have access to information about an even wider range of (lower value) payments. Thea would previously have been obscured by the opacity of the cash economy.

Mis-selling and other scandals undermine customer trust

Recent scandals include:

- Equitable Life

- LIBOR fixing

- Split capital investment trusts

- Precipice bonds

- Keydata

- Arch Cru

- PPI Mis-selling

Regulatory fines include:

- Barclays: Fined £26 million in May 2014 for manipulating the gold price (gold-fix manipulation).

- Santander: Fined £12.4 million in 2014 for “serious failings” in its investment advice arm, including mis-selling investment products to customers.

- HSBC was fined £10.5 million in 2011 for mis-selling investment bonds to elderly clients

- Lloyds was fined £28 million over the incentives it offered to retail investment staff

- Royal Bank of Scotland (RBS): Fined £390 million in 2013 for its role in the LIBOR interest rate rigging scandal. (source)

- Prudential: Fined £30 million in 2013 for failing to inform the regulator about its approach to a major acquisition, and for poor governance and controls. (source)

- Aviva: Fined £8.2 million in 2016 for failings in the oversight of outsourced providers, which led to poor outcomes for customers. (source)

- Standard Life: Fined £30.8 million in 2019 for failures relating to the sale of non-advised annuities, where customers were not given sufficient information to make informed decisions. (source)

Firms operating in the UK who've been fined for activities in other markets.

- 2016: Deutsche Bank tentatively agreed to a deal involving £5.8bn over the sales of mortgage bonds just ahead of the financial crash.

I remember listening in to a focus group in which participants were discussing which financial services brands they trusted. One participant remarked, "Well, I have heard of them, and I don't think it was for anything bad, so they're probably trustworthy" as if he was surprised that there might have been any good news about a financial services brand.

This lack of trust will make it easier for new entrants with more innovative propositions to win market share from the incumbents.

- Barclays:

- Standard Life:

- Royal Bank of Scotland (RBS):

- Lloyds Banking Group:

- HSBC:

- Santander:

- Prudential:

- Aviva:

NEST could undermine competitiveness in the pensions sector

NEST is a parastatal set up in competition to private sector pensions providers. Because it is heavily subsidised by the Departent for Work and Pensions ("DWP"), it could make it harder for private sector providers to compete, force many out of business, resulting in consolidating of the maret and a loss of innovation and choice for employers and consumers.

NEST's annual report shows the DWP loan has increased by 30 per cent to £387m, up from £300m 12 months ago. In addition, an annual DWP grant used to pay off the loan increased from £10.2m to £12.7m this year. (Summer 2015)

One commentator noted that: "NEST was borne of the typically erroneous presumption on the part of a bunch of blinkered civil servants that private sector providers are over-charging and ripping off consumers. Now they’re trying to do it themselves, they find that it can’t be done for peanuts."

New entrants to the market are disrupting with technology

Whilst most established providers ar encumbered by complex legacy systems, there is a risk that startups, making more effective use of technology, could disrpt the market.

See for example:

- AllLife, targets HIV and Diabetes sufferers, using technology to present itself as the big-and-tall of the life insurance industry.

- Nutmeg

Online financial planning website could plug the advice gap

See MoneyVista (now Royal london financial planner)' retireReading, a service from Aegon. According to research form NFU mutual, one in 7 people making a big financial decision turns to family, whilst one in 6 rely solely on the internet.Peer-to-peer lending is growing rapidly

It passed the £1.5bn mark in May 2014, growing by 50% in 5 months. It is now included in the FCA's regulatory regime.

At some point peer-to-peer lending will stop being seen as a threat to the financial services in dustry and start being seen as a component of the financial services industry.

Pensions freedoms could expose the market to mis-selling and scams

The Pensions Wise website still contains misleading information. Everyone is trying to distance themselves from the fallout. The government is positioning advisers and providers as the first and second lines of defense. Advisers are considering their qualifications and also distancing themselves from insistent customers. Providers are starting to insist on customers transacting through advisers.Products are too complex and use too much jargon

Financial jargon has been compared to the Orwellian "Newspeak" from the novel 1984. (The Telegraph)

In a survey carried out by the Insurance Industry Quality Mark Scheme, found that nine in 10 people agree that financial phrases should be put into clearer English. (Mortgage Strategy)

John Lister, spokesman for the Plain English Campaign, says: "Financial services is the worst sector in terms of how much a consumer can misunderstand what is being said, which can be serious if it influences the financial well-being of the client." (Mortgage Strategy)

Customers are intimidated and confused.

Providers could be forced to offer advice, directly or via a partnership, in order to serve the mass market

All the pensions freedoms will have a lot of customers phoning their provider wanting to execute those freedoms: The providers are obliged to serve as a second line of defense. This could be by offering: - guidance - referral to Pensions Wise - advice (directly) - referral to an independent adviser.Providers have a massive estate of customer assets

If providers did nothing new, it would take many years before their financial positions started to unwind to the point that the lost all of the advantages of scale.

Artificial Intelligence and Automation could make financial services more affordable

- Financial Advice:

- Robo-advice could make advice more affordable.

This could be a boon to providers wishing to go direct to consumers, as well as to advisers wanted to provide tiered levels of service to different customer segments.

The regulatory framework, however, remains far from clear.

Research from Which? suggested 58% of people would not currently want to accept an advice recommendation from a computer. Key to combating such concerns is assurance that a reduction in cost is not at the expense of quality. Source: Pension freedoms - Work and Pensions Committee - House of Commons

As artificial intelligence becomes more widespread and people get used to the idea, will they become more accepting of it, or will AI only ever be something that helps a human reach (but then vet) a recommendation more quickly?

-

- This could make advice affordable to a wider target market (i.e. those with relatively fewer investments).

- The impact would be greatest in the more data-intensive and research-based areas like paraplanning.

- Investment Management

- Algorithmic trading could make investment management more affordable.

- Insurance:

- AI could reduce the costs of underwriting new business and processing insurance claims.

The 2014 budget provided the biggest shakeup of retirement savings in a generation

Retirees are no longer compelled to take out an annuity. Just retirement saw a 50% decline in annuity sales in q1 and announced a £14m cost savings drive. Partnership launched a 1 year get out clause if annuitants can get a better deal elsewhere. Standard life, and legal and general have both said that annuity sales were down. Specialist annuity firm MGM is cutting almost a third of its 250 strong workforce. Aviva saw new business fall 22 percent as a result of the shakeup / mainly due to the sale of annuities. City AM 16 May 2014.The FCA could continue to intervene in the provision of financial services

The launch of NEST and the provision of 'financial advice' through the Money Advice Service could simply be the thin edge of the wedge. Whilst these initiatives are subsidised by industry levies and the Treasury, it will be hard for private firms to compete.

See also:

The mass market is underadvised

Post-RDR IFAs will be less likely to serve the mass market (ordinary people with average incomes and wealth) with advice as they can no-longer cross-subsidise these from their wealthier clients. The banks have also historically been active here, but they are starting to withdraw from this sector in the face of increasing regulatory burden and costs. -In 2011 Barclays stopped providing financial advice through its retail branches. -In September 2012, Lloyds Banking Group made a similar announcement. The 2014 budget, offering greater flexibility at retirement, will only serve to increase the need for advice. (Although the DWP has simultaneously tried to blur the line between advice and guidance.)The pensions charge cap could distort the market

Aegon says pension charge cap to cost firm £25m a year Money Marketing, 22/05/2014, p.16, Unattributed Aegon estimates the pensions charge cap will cost the business up to £25m a year. The Department for Work and Pensions confirmed in March that any scheme with a charge of over 0.75 per cent would not be eligible for autoenrolment from April 2015. In addition to establishing a charge cap, it could also become a defacto charge floor with some firms artificially sustaining that price level (although many funds are already priced below that level).The Simplified Products initiative could further commoditise the market

Carol Sergeant reported back to Mark Hoban during July 2012. We are now in a period of consultation. A simplified products regime could further commoditise the market, leaving providers able to compete on price and service, but not product features, and playing into the hands of the price comparison sites.The size of the advice market is constrained

The FCA has just launched The Financial Advice Market Review ("FAMR", already dubbed RDRII). It aims to:

- Examine the advice gap.

- Look at ways to ensure the regulatory and legislative environment allows and encourages firms to innovate and grow their business models to include affordable and accessible financial advice.

- Considers ways to encourage people to seek financial advice, addressing unnecessary barriers that currently deter them

- Commission disclosure (90's)

- Depolarisation (2005)

- The end of commission (RDR - early 10's)

- Regulatory fees (Regulatory fees - mid-10's)

- Consolidation (periodic but ongoing)

Historically, many advisers were trained in life offices before becoming independent advisers, but that avenue is no longer open. Few advisory firms have the capacity to train new advisors, and those that do, do so in relatively See Philsmall numbers.

Challenger Banks

The latest challenger bank, Tandem, was announced in September 2015.

Shawbrook paoched Santander's Head of UK Banking in October.

Most challenger banks are led by technologists.

Fintech is booming

There are 5 main growth areas:

- Payments (especially mobile)

- Cryptocurrency (including blockchain adoption)

- Retail financial services (including robo-advice)

- Institutional financial services (including the trend to replace administrative personnel with technical personnel)

- Capital formation / equity financing (including crowd-funding)

Incumbents may struggle to compete because:

- they are weighed down by huge legacy costs and fixed costs bases.

- over-regulation has smothered competition, with most providers offering similar products at similar prices with similar conduct risk problems.

- it will be hard to pick the winners from the losers - a startup can afford to lose more than an established brand.

A recent global study study found that 43.1% of financial services executives though Fintech was a significant threat.

There exists a protection gap

The "protection gap" in the UK financial services sector refers to the significant portion of the population lacking adequate insurance coverage to safeguard against financial hardships resulting from unforeseen events such as death, illness, or loss of income. This gap leaves many individuals and families vulnerable to financial instability.

Extent of the Protection Gap:

-

Life Insurance: As of 2022, only 29% of UK adults had life insurance, indicating that over 70% remain without this essential coverage. (AMI)

-

Critical Illness Cover: Approximately 13% of adults possessed critical illness insurance in 2022, leaving a vast majority unprotected against serious health issues. (AMI)

-

Income Protection Insurance: Only 6% of UK adults had income protection insurance in 2022, highlighting a significant vulnerability to income loss due to illness or injury. (AMI)

Factors Contributing to the Protection Gap:

-

Awareness and Understanding: Many consumers lack awareness or have misconceptions about protection insurance products, leading to underestimation of their importance. (FCA)

-

Affordability Concerns: Perceived high costs deter individuals from purchasing insurance, even when affordable options may be available. (FCA)

-

Complexity of Products: The complexity and variety of insurance products can overwhelm consumers, resulting in decision paralysis or inappropriate choices. (FCA)

Implications of the Protection Gap:

The lack of adequate protection insurance can lead to severe financial distress for individuals and families during critical times. Without sufficient coverage, unexpected events can deplete savings, increase debt, and reduce living standards.

Recent Developments:

In response to these concerns, the Financial Conduct Authority (FCA) has initiated a market study into the UK's insurance industry, focusing on "pure protection insurance products" such as critical illness cover, income protection insurance, term assurance, and whole of life insurance. This investigation aims to assess the competitiveness of the market and ensure that consumers are not being misled or disadvantaged. (The Times)

Conclusion:

Addressing the protection gap is crucial for enhancing financial resilience among UK households. Efforts to improve consumer awareness, simplify product offerings, and ensure fair pricing are essential steps toward closing this gap and providing better financial security for all.

Some markets continue to operate on a commission basis

The Retail Distribution Review removed this for investment products, but protection products continue to operate on a commission basis. Commission distorts the market by introducing a product/provider selection criteria which does not align with customer interest or suitability.

Low inflation

There is a low inflationary environment. Interest rates make savings products unattractive. Annuities can be perceived to be poor value.

This environment could push investors towards more risky investments, creating the conditions for another crash.

FCA has been tasked with setting a cap on pension exit fees

From: ILAG Insights 19 January 2016

FCA has been tasked with setting a cap on pension exit fees. FCA’s data shows that of 670,000 accessing pension freedoms who paid an exit fee 358,000 faced charges between 0-2%; 165,000 faced charges between 2-5%; 81,000 faced charges between 5-10%; and 66,000 faced charges above 10%.

Brexit could result in significant legislative and regulatory change

Impacted regimes could include:

- Solvency II

- Basel II

- MIFID

- PSD II

Disintermediation & Robo-advice

Disintermediation has been on the cards for years without gaining significant traction. However, with ongoing advances in Fintech, and continued pressure from the regulator, some disintermediation is inevitable.

Extra-industry firms may have access to better data for assessing risk

Insurers have long had a monopoly on the data required to assess risk. However, with the advent of telematics and wearable computing, other types of business now have acess to different, and possibly better sources of data, and could use that to introduce new and better products and services.

Telematics and wearable technology could revolutionise underwriting

Historically, underwriting has been based on data which is easily verifiable, rather than data which is most relevant. The advent of telematics and wearable computers could change that.

The current emphasis is on postcode pricing. Short-term providers are already using this. Life insurers are eyeing it nervously: nobody wants to go first, bu they all recognise that the need to be ready to follow if anyone else starts, in order to remain competitive. Telematics and wearable computers could leapfrog postcode pricing.

Telematics could be used to encourage and reward better driving.Aviva and LV= have signed up to Octo U, who use a

Wearable technology could help to identify and motivate the best quality lives, as well as to help those with chronic conditions manage and report on their conditions.

Companies already exploring this include:

Surify - John Hancock Vitality (US)

- Manulife MOVE (China)

- Vitality (Active Rewards programme)

- AIG (US) to monitor construction works activity risk.

'Regtech' could help financial services providers streamline the costs of regulatory compliance

Regulatory compliance is one of

However, Regtech is still the "sleeping giant" of the financial services world, according to FCA director of innovation Nick Cook. Source: FCA: RegTech still 'sleeping giant' of financial services published 07/11/2019

PSD II could open up the payments infrastructure

The EU’s Payment Services Directive (PSD), which became law on 1 November 2009, ensures that the rules on electronic payments — e.g. paying by debit card or transferring money — are the same in 30 European countries (European Union, Iceland, Norway and Liechtenstein). This means that you will be able to make payments throughout Europe as easily and safely as in your home country.

InsurTech / InsTech

This is the equivalent of Fintech, in the insurance industry.

"In the future people will engage with life insurers differently. We can predict that mecosystems - concepts that have the customer at the centre of everything - will drive a new model for life insurance. The re-emergence of mutuality, in the form of peer-to-peer insurance and social broking activities, is a good example.

Customers are increasingly better equipped to manage and collect their own health data. Self-monitoring using wearables and health apps is here to stay, and it’s already clear that people will share some personal data with their insurers if it provides the policyholders with an advantage. Soon more individuals will demand insurers move from one-size-fits-all solutions to unique ones based on a customer’s unique data.

Providers that knit themselves into the fabric of policyholders’ lives will provide them more of the services they demand. Artificial intelligence and machine learning will drive this, and for the moment insurers can propel this process forward. Better use of analytics will clarify buying triggers, provide granularity to the process of take-up and allow the industry to adjust life-staging models.

In addition to big data, behavioural economics will be used to influence how life insurance customers interact with and share their data. Harnessing that power means deploying the best of data-driven information to influence and nudge insured and previously uninsured individuals into buying."

From: Trends in Life Insurance - How Can the Industry Stay Fit for the Future? | Gen Re

The secondary market in annuities could have several disrupting impacts

Especially:

- Impaired lives who were not underwritten and accepted standard rates at the original point of purchase, but are underwritten and offered reduced rates at the point of secondary sale may initiate a misselling claim in respect of the original purchase. Where underwriting can be used to offer a better annuity payout, this may be preferable to providers over the alternative of buying out and cancelling the policy.

- Distressed sellers who later realise that they sold their annuities for less than they might subsequently think they were worth may initiate a misselling claim in respect of the secondary sale.

The secondary market in annuities is due to open in April 2017. There are an estimated 5m annuities presently in force. The proceeds of an annuity sale will be taxed at the recipient's average rate of taxation (I think...)

Some 500k of annuitants could try to cash in their annuities.

Some will be

- current interest rates are likely lower than they were at the point of original purchase

- an annuity purchase would likely re-underwrite the annuitant. Where the annuitant was not, but should have been underwritten at the point of original purchase, or where their health has subsequently deteriorated, the purchaser will likely offer a lower rate. (Although, of course, this category of person is likely to be relatively better off by selling their annuity).

By contrast, increasing life expectancy might make it more attractive for purchasers to offer a higher price for annuities.

In all case, information asymmetry between the seller and purchaser will inevitably leave the seller at a disadvantage.

Where the original sale was on standard rates, and not underwritten, but it turns out that the annuitant is/was a smoker and probably could have got an enhanced rate originally, and where the prospective purchaser then does underwrite the annuitant and determines that they are a poor life, the relative price

Others will accept the price offered and subsequently realise that it was not a good deal and pursue

Sales of

Where an annuitant has sold their annuity, they have little, if any incentive to advise the annuity provider of any chance of address, making it harder, if not impossible for the provider to determine if the original annuitant is still alive.

Is there an opportunity for providers to offer to underwrite lives retrospectively and increase the amount of the monthly annuity payment as an alternative to cashing the annuity in (or would the create an anti-selection problem in the rest of the book)?

Personalisation and gamification can increase customer engagement

Soon customers will come to realise that organisations that don't personalise their user experiences are more interest in what is convenient

Gamification can be used to move and reward customers through small steps - not just transact or don't transact. Gamification can be used to ensure customers don't get the same messages at every interaction but instead always get something new: a recommended next best action, based on all of the other actions they've taken so far.

See also:

The Insurance Distribution Directive (IDD)

The FCA published the first of two consultation papers on 6 March 2017.

The IDD, with which the UK is required to comply by 23 February 2018, concerns the distribution of insurance and reinsurance, and also covers assisting in the administration and performance of an insurance contract post-sale.

The consultation paper covers the FCA’s proposals for the application of the directive, which include the following areas:

- professional and organisational requirements

- complaints handling and out-of-court redress

- professional indemnity insurance (PII)

- changes to conduct of business rules (for non-investment insurance contracts)

- the regulatory regime for ancillary insurance intermediaries

The Personal Information Economy (PIE) could provide new ways for companies to access individuals' data securely and with all permissions in place.

This could increase data transparency while ensuring GDPR compliance.

See the Personal Information Economy in the Trends Series

The adviser platform market is consolidating

There are currently more than 15 players competing for advisers attention. (Source: Tom Ellis: How Embark Group became the new platform beast published 21/11/2019)

- Tier 1: £50bn+ of Aegon, Standard Life (purchased Cofunds and Elevate) and Quilter's Old Mutual Wealth.

- Tier 2: £30bn+ of Embark Group (£33bn), Transact, AJBell and Fidelity Funds Network

Elsewhere, after months of speculation FNZ finally completed the acquisition of platform tech rival GBST. This means the majority of adviser platforms, including big guns, Standard Life Wrap and Elevate, Aegon, AJ Bell, and soon to be Old Mutual Wealth, will be powered by the same company. If they are then consolidated onto the same underlying technology that could have significant and interesting ramifications for the market in terms of concentration risk and a potential lack of differentiation. It is certainly one to watch closely – we certainly will. (from email)

FNZ and GBST were the two biggest platform technology names in the UK, providing the underlying technology to 10 of 18 major adviser platforms. "All the big brands will be using the combined organisation, " he said. "I think from the adviser point of view, they'll be wanting to understand what it means for them. Source: FNZ completes acquisition of platform tech rival GBST published 06/11/2019

- Old Mutual Wealth:

- AJ Bell:

- Aviva:

- Quilter:

- Abrdn:

- James Hay:

- Elevate:

- FNZ:

- Standard Life:

- Aegon:

- Embark:

Crypto-currencies

"The longer traditional banks push back on crypto the more they damage their future. Whether any of us like bitcoin or not, its march will continue.” (Source: Will UK lenders accept bitcoin for mortgage payments? - FTAdviser.com published 27/08/2021)

However, you still can't pay your taxes or mortgage in the UK with cryto-currency.

People are becoming more reliant on retail credit

From: To ‘Apple Pay Later’ or not to... What Buy Now Pay Later Shopping Sprees Could Cost You

- Nearly half of adults under 35 don’t own a credit card, but a third use BNPL to help with cashflow.

- Citizens Advice reported that one in 12 people are using Buy-Now-Pay-Later (BNPL) services.

- Around 17million UK shoppers use retail credit.

More advice is being delivered remotely

- Me working remotely saves me time which I can invest in StratNavApp.com and business development. It also increases my targetable market without increasing the cost.

- Other people working remotely introduces more competition.

Are people starting to return to the office more, or will this stick?

DB to DC to CDC?

DC is taking over from DB

- UK FTSE350 still pay more into DB than DC. But that is forecast to change by 2027.

But DC provides a pension pot, not a pension income.

Will CDC fill the gap?

- As of 1 August 2022, providers are able to apply to launch Collective Defined Contribution (CDC) schemes.

- The Royal Mail Collection Pension Plan was the first (and currently only) CDC to receive authorisation from TPR. (Source: Royal Mail CDC scheme gets the nod from TPR – mallowstreet and Source: https://www.ai-cio.com/news/uk-authorizes-first-cdc-pension-plan/ published 11/05/2023)

- TPR published a list of authorised CDCs. There is currently only 1 on the list.

- These pool longevity and mortality risk (like DB) but do not have an employer covenant (like DC).

- TPT have said they are exploring CDC. Source: Why TPT is exploring CDC - More - Pensions Expert published 08/11/2023)

-

TPT Retirement Solutions:

- TPT have said they are exploring CDC. Source: Why TPT is exploring CDC - More - Pensions Expert published 08/11/2023)

-

Clara-Pensions:

A major evolution in endgame strategies for defined benefit pensions schemes saw the first superfund consolidator deal completed between Sears Retail Pension Scheme and Clara-Pensions. (Source: Overview of the first ever superfund deal – mallowstreet)

Consumer Duty

The Consumer Duty is:

- An outcomes-based regulation, and therefore,

- A step up on Treating Customers Fairly (TCF)

The Consumer Duty came into force on 31 July 2023 for new and existing products or services that are open to sale or renewal. For closed products or services, the Duty will apply from 31 July 2024. Source: Countdown to the Consumer Duty | FCA

The FCA’s own estimate is that one-off implementation costs for the sector could be as high as 2.4bn. (Source: How the consumer duty will affect advisers' day-to-day operations - FTAdviser.com published 04/08/2022)

It includes 3 cross-cutting rules, requiring firms to:

- act in good faith;

- avoid causing foreseeable harm; and

- enable and support retail customers to pursue their financial objectives

The outcomes relate to:

- products and services;

- price and value;

- consumer understanding; and

- consumer support.

Source: Using tech for consumer duty compliance no longer luxury - FTAdviser.com published 30/08/2022

Compliance will require much more detailed reporting, which will require much more detailed data, beyond what can be manually captured in simple spreadsheets. (Source: Using tech for consumer duty compliance no longer luxury - FTAdviser.com published 30/08/2022)

Initial impacts include:

- 40% of advisers say their firm has seen an increase in protection conversations with clients as a result of consumer duty. Source: Advisers have more protection conversations following consumer duty - FTAdviser

- Firms will become more reliant on data to mitigate risks of non-compliance.

- Financial Conduct Authority (FCA):

The market is consolidating

See also: Insight - The adviser platform market is consolidating

Pensions Schemes: the tabling of the general code will increase the regulatory burden and will especially impact the smallest schemes, many of which will have adopted a proportionate approach to governance and are now likely facing the largest hurdles.

Pensions Master Trusts: For example, Smart Pension has acquired the Ensign Master Trust, consolidating it into the Smart Pension Master Trust. (Source: Smart Pension consolidates the Ensign Master Trust published 02/11/2022)

A new VfM framework is being considered which:

- will force underperforming DC schemes to close to new business in order to

- drive consolidation in order to achieve

- better governance and

- more investment in illiquids. (Source: New VfM framework targets ‘poor performers’ for consolidation – mallowstreet)

-

Smart Pension:

Consolidated the Ensign Master Trust.

- Clara-Pensions:

The bulk annuity market is booming, for now

There are now nine active insurers in the UK bulk annuity market.

All bulk annuity insurers in the UK offer full-scheme transactions.

Market Dimensions (from Aon Report)

- 85% of these insurers are committed to increasing transaction volumes over the next 5 years.

- ~1.5m lives covered.

- ~£220bn total value to mid-2023

- £28bn deals in 2022

- £21bn deals in H1 2023 (expect to rise to ~£50bn by year-end)

In July 2023, WTW reported that UK private sector DB Schemes held around £1.5trn in assets and that they are better funded than ever.

What is the half-life of the remaining DB Schemes to transact given this rate of transactions combined with the natural attrition of closed schemes? (It may be less than 10 years)

A shift towards workplace has a negative impact on individual business (esp life/IP etc.) but this could have long-term impacts if/when you leave

Doesn't apply to Gig enconomy or employees of smaller firms.

It is always safest to have your own individual policy - gives you freedom.

Control

Generic Groups

Distribution

It is harder for independent advisers to remain in business:

- The RDR increased regulatory costs before any actual advice is given.

- Technology is driving economies of scale for larger distributors.

Traditional advice must consolidate, but will innovation create new, non-traditional models?

Providers are forgetting the regulatory pains of days gone by and starting to acquire distribution again.

This may be partly owing to the PE firms who funded adviser consolidation now looking for exits, and providers being among the few who can afford the price tags.

Aviva's acquisition of Succession Wealth is one such example. Aviva has said they expect to continue Succession's M&A activity.

Plymouth-based IFA business Continuum was just one of 41 firms with more than 50 advisers in 2021, according to the latest Retail Mediation Activities Return (RMAR) data revealed by the Financial Conduct Authority (FCA). The research showed that the number of firms with more than 50 advisers rose 17% from 35 firms in 2020, as consolidation within the financial advice market continued to narrow the number of smaller firms. In 2020, there were 4,581 firms with between one and five advisers, in 2021 this fell 4% to 4,396 firms. Source: Number of smaller advice firms continues to shrink, analysis finds published 12/08/2022

Aviva’s acquisition of Succession Wealth is expected to complete “imminently” and the provider said it expects the business to continue its M&A activity post-finalisation. Source: Aviva UK boss: Expect more consolidation from Succession published 10/08/2022

Old Mutual / Skandia purchase Intrinsic earlier this year.

Insurers

See Insurance Times top 50 Insurers report 2024: https://digitaleditions.insurancetimes.co.uk/html5/reader/production/default.aspx?pubname=&edid=a061ed1b-753d-41bc-94c4-78f1949efe12